- | 9:00 am

Why do financial advisors hate lattes?

Experts weigh in on why women are better without a gender lens on expenditure.

I’m at my usual café, having an iced latte – ice has melted and coffee diluted; I’m unsure if it’s summer to blame or all the mansplaining around this small pleasure. Or is it because I saw a campaign by one of the UAE’s largest banks suggesting that a $3 daily latte – $1095 annually – could be a roadblock to saving for the future?

With no statistical backing, lattes receive a blow for being an indulgence.

“Clichés are a poor substitute for facts. Coffee consumption, from latte to espresso, is gender-neutral, although the French will consider a latte as a children’s breakfast beverage,” Caroline Whitfield, an Academic and Practitioner in Entrepreneurship at Strathclyde Business School.

“Women adopt spending habits that are partly socially determined, but why is one purchase better than another? In a capitalist economy, there is no need to seek moral benchmarking of one consumer purchase type over another.”

Like the layered milk and espresso in a latte, there are layered problems with financial advice given to women.

“Instead of trite advice like cutting back on lattes, we should seek to understand the deeper issues at play, like unavailable or insufficient maternity leave, the unfair share they have of home and child responsibilities, and come up with progressive, tangible solutions that will create deep and lasting social impact,” says Marilyn L. Pinto, founder at KFI Global.

Overall, the idea of trimming your spending on little purchases, such as coffee, bottled water, and fast food, can make a difference between saving and living paycheck to paycheck have financial advisors divided.

“We have heard so much about ‘drop your latte’ as the best way to start investing and reduce those calories, and why not bundle that into saving the planet? I am all for the latter. We do not need to drop our latte to start building for a better future,” says Nadine Mezher, co-founder and CMO at Sarwa.

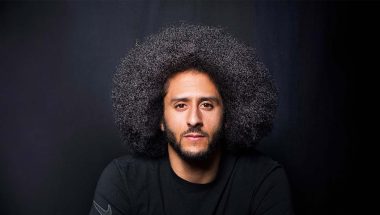

QUESTIONING THE LATTE FACTOR AND WOMEN

Consider a few facts the next time you hear a man tell you to drop the latte.

“The stereotype that women do not do well with money is far from the truth. Women today face many gaps: pay, promotion, career, and investing. All those gaps make it more challenging for them to achieve financial independence, but it is not impossible,” says Mezher.

“A balanced expenditure is to be encouraged, but within that, one person’s gym session is another person’s takeaway habit, but they all fuel jobs, taxation, and maximize personal choice,” says Whitfield.

Research shows that when women invest, their portfolios outperform their male counterparts. “Yet we tend to lack confidence in our ability and are hesitant to start. It just shows that we all need to take action,” Mezher adds.

The investment industry is historically built to cater to a male segment: from communication and messaging to representation in the field. But this is changing, slowly, says Mezher. “There is much room to grow.”

According to Whitfield, the more serious point is that people, particularly the newer millennials, generations X, Y, and Z, are rethinking the role of long-term saving vs. debt leverage and a focus on today vs. planning for the future. “The world seems benighted with climate change, geo-political instability, and increasing financial precarity. Work patterns now require reskilling 3-5 times throughout working life.”

She adds these new generations seek personal well-being experiences through food, luxury, and travel to reconnect with what is real and meaningful.

“Is a small indulgence today a way to manage anxiety about an uncertain future?” asks Whitfield.

The nature of saving is evolving, and so should the outlook on investing. “Savings now are about specific goals, often including continuous education and travel, and saving for a far-off asset seems no longer the only path for a successful life. The social move to being more aware of the transience of life and savoring the present moment, whether over a coffee or not, might be a return to the ancient wisdom of how we may all live our best lives,” says Whitfield.

Spending on small indulgences is essential to living. “If you are spending more than you can afford or more than your financial planning can handle, by all means, drop the latte. But also, rewarding yourself is good. Having a coffee break with friends and family is good,” says Mezher.

It’s common for people to pay undue attention to small extravagances like lattes and avocado toast. But the reality is that big-ticket items move the needle on financial security, like mortgages, education, health insurance, and childcare. “These items must be evaluated, debated, and discussed to find a solution that best fits one’s financial plan,” says Pinto.

BEST WAY FORWARD TO SAVE MONEY

According to Mezher, there are several ways to govern your savings. It starts with assessing your financial situation, monthly overall spending, income sources, and debt. Ensure you have a complete picture of where you stand, what risk you can tolerate, and your goals (buying a house, retiring comfortably, etc.).

Once you have a big picture of your standing, Mezher suggests getting rid of any bad debt.

“Once that is out, build an emergency fund as a savings account. How much depends on your situation: it is what you think you need to survive debt free if you have no income being generated.”

Beyond the emergency fund, look into investing that extra money saved. Money sitting idle can lose to inflation. Put it to work for you the same way you work hard for it. Mezher says investing smartly is essential, starting as early as possible and diversifying your investments.

“Each person has a different financial situation, so do your due diligence, talk to an advisor, and remember that investing involves risk-taking.”

Ultimately, focus on what’s important to you. Set your saving goals, take the rest of your money, and spend guilt-free on things you love, including booking your next vacation, flying first-class, and having a latte daily.