- | 11:00 am

Abu Dhabi’s TAQA sets up green finance framework to fund environmentally responsible projects

The funds generated from the issuances will be directed towards financing environmentally responsible projects.

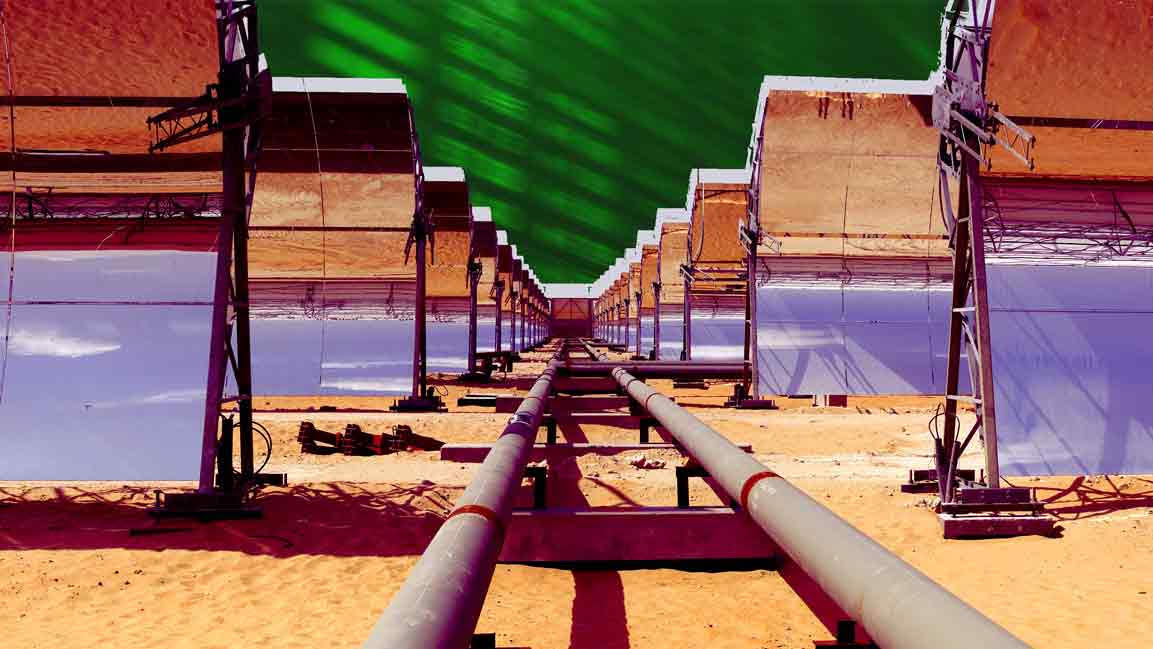

TAQA, the Abu Dhabi National Energy Company, is establishing a new framework for green finance. This framework will facilitate the issuance of various sustainable financial instruments such as green bonds, sukuks, loans, and other debt instruments.

As one of the largest integrated utility companies, the firm has outlined its intentions to utilize the funds from the issuances to finance eligible green projects, including renewable energy, energy efficiency, sustainable water and wastewater management, clean transportation, and terrestrial and aquatic biodiversity.

According to Jasim Husain Thabet, the Group CEO and Managing Director of TAQA, the projects financed through this framework will make significant contributions towards TAQA’s 2030 ESG targets and its long-term net-zero goal.

“This framework is further evidence of how serious we are about putting sustainability and responsible business practices at the heart of everything we do, as we also support the UAE in achieving its Net Zero by 2050 objective,” said Thabet. “Our emission reduction targets are backed by a business plan and credible projects that will see us play a key role in decarbonizing the power and water sector, as well as other industries in the UAE and around the world.”

As joint sustainability structuring banks, Citi, Standard Chartered Bank, MUFG, and HSBC have extended their support to the firm. First Abu Dhabi Bank has also joined as a sustainability finance framework advisor.

TAQA’s green finance framework is designed to conform with the global best practices set out by the International Capital Market Association (ICMA) under the four core components of the Green Bond Principles 2021. Moody’s Investor Services has also provided a Second Party Opinion (SPO) for TAQA’s framework.

Moody’s has evaluated the framework and assigned it a Sustainability Quality Score (SQS2) of ‘Very Good’, the second-highest rating under their SPO scoring framework. This score indicates that the framework will make a considerable contribution towards sustainability.

In 2022, the firm announced its 2030 ESG plan, which outlined interim goals for reducing greenhouse gas emissions. The company pledged to reduce scope 1 and 2 emissions by 25% across the Group by 2030, with a 33% reduction target for emissions from the UAE portfolio, using 2019 as a baseline. Additionally, TAQA committed to increasing its share of renewable energy in its total generation capacity to at least 30% by 2030.