- | 11:00 am

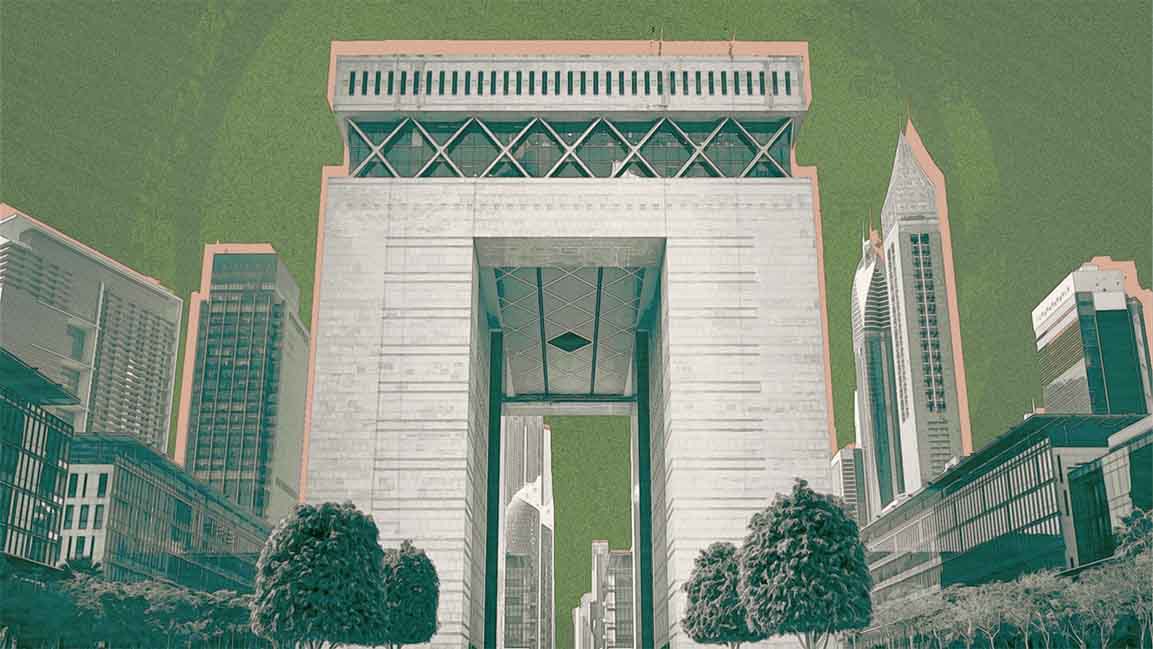

DIFC is reinforcing Dubai’s position as a global hub for sustainable finance, says Essa Kazim

Nasdaq Dubai accounted for approximately 64% of the world's dollar-denominated sustainable sukuk market

Dubai is a major hub for green funding, as sustainable finance proliferates as GCC governments and corporations push to meet climate goals by 2050.

Green and sustainable bonds and sukuk issuances in GCC economies boomed in 2022, reaching $8.5 billion from 15 deals, up from $605 million from six deals in 2021. Banks and government-related entities drove the increase.

The Dubai International Financial Centre (DIFC) is playing a leading role in boosting sustainable finance globally as demand for green funding picks up in the region and beyond, according to DIFC Governor Essa Kazim.

As of September 2023, Nasdaq Dubai, the DIFC’s international exchange, accounted for approximately 64% of the world’s dollar-denominated sustainable sukuk market ($16.4 billion out of $25.8 billion) and 46% ($17.5 billion out of $38.3 billion) of the overall market, making it the largest ESG sukuk market in the world.

“The current outstanding listing value for ESG bond and sukuk on DIFC Nasdaq Dubai is $24 billion today, reinforcing Dubai’s position as a global hub for sustainable finance,” Kazim said.

“The DIFC is committed to its role in driving the sustainable finance agenda,” Kazim said in a speech at the Future Sustainability Forum.

“We believe that sustainable finance is essential to achieving the UN Sustainable Development Goals and creating a more sustainable and inclusive future.”

Sukuk are Islamic bonds structured to comply with Sharia law, and they are becoming increasingly popular among investors who want to invest in a way that is aligned with their values.

The DIFC also announced the debut listing of a $350 million green bond by FIVE Holdings on Nasdaq Dubai. Kazim said the finance center was following through on the roadmap laid out by the government to “drive tangible progress to climate action.”

According to Kazim, an estimated $4 to $5 trillion in annual investment is required to meet the UN’s 2030 agenda for sustainable development goals.

“The need for sustainability has been growing at a rapid pace with a strong demand from investors for governments and the private sector to deliver on sustainability commitments,” he added.