- | 2:00 pm

Egypt fintech sector hits multimillion-dollar peak of investor interest

During the last three years, an average of 65% of investments were attributed to venture capital and angel investments in the fintech sector, reaching a new record of $358.8 million in 2022.

Now accepting applications for Fast Company Middle East’s Most Innovative Companies. Click here to apply.

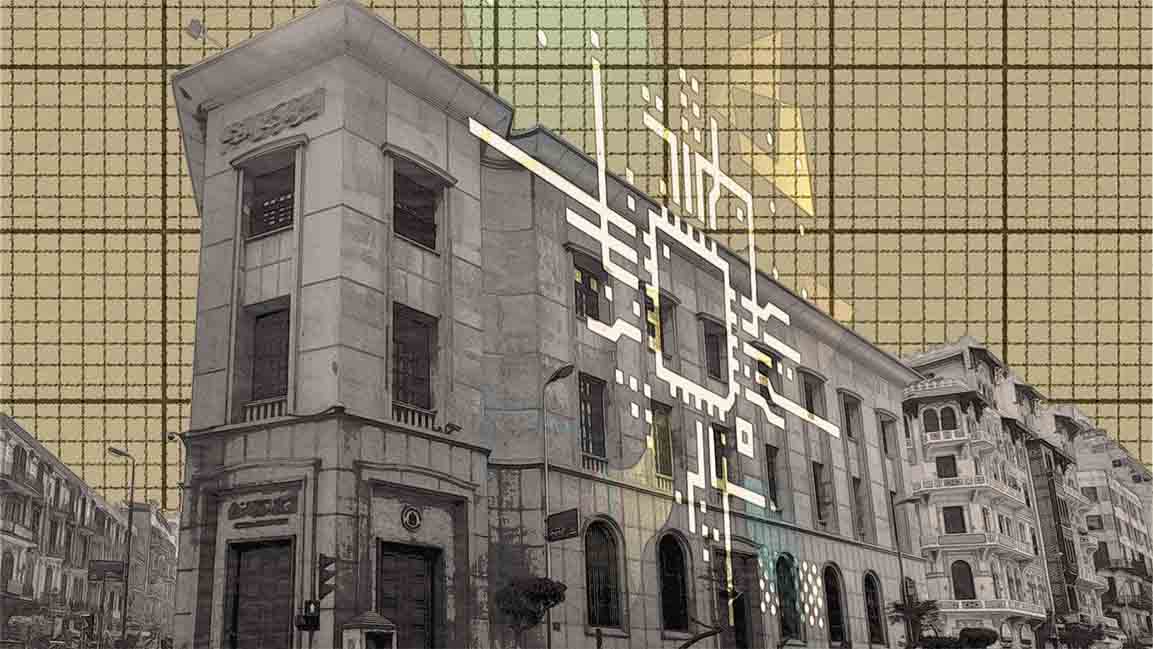

Egypt’s digital finance industry, more commonly known as the fintech sector, has hit a multimillion-dollar peak of investor interest, so much so that the Central Bank of Egypt (CBE) has stated that the fintech sector is one of the main pillars in the banking and financial sector in the country.

In the recently issued Financial Technology Egypt 2023 Perspective Report, CBE said Egypt wants to support and encourage fintech innovation.

This will aid in transforming the country’s economy to becoming less dependent on banknotes, falling in line with the Egyptian economic reform program.

During the last three years, an average of 65% of investments were attributed to venture capital and angel investments in the fintech sector, reaching a new record of $358.8 million in 2022, 28.7 times more than in 2019. Moreover, private equity investments soared in 2022 to 55% of total fintech investments.

According to the CBE, last year saw remarkable growth in the fintech sector. However, this development was no coincidence; the rise of Egyptian startups and increased exports worldwide helped attract local, regional, and international investors.

The bank also said 177 startups operate in fintech, including 139 startups providing solutions.

In Egypt, over the past five years, the fintech startup ecosystem has grown 5.5 times more, with 67% based in Cairo and 30% in Giza, while 3% are headquartered outside the two cities, says the CBE.

Some startups, 17 out of the 113 in Cairo, even have additional offices outside of Egypt, such as 58% in the UAE, 36% in Saudi Arabia, and 18% outside the MENA region.

CBE said that three sub-sectors dominate the fintech realm in Egypt so far– the payments and transfers sector makes up 36%, followed by the lending and alternative financing sector with a percentage of 11%, then the business owners’ platforms sector with a percentage of 10%.

The bank also revealed that the total number of clients of financial technology startups and payment service providers in Egypt reached 99.9 million by the end of 2022.