- | 3:00 pm

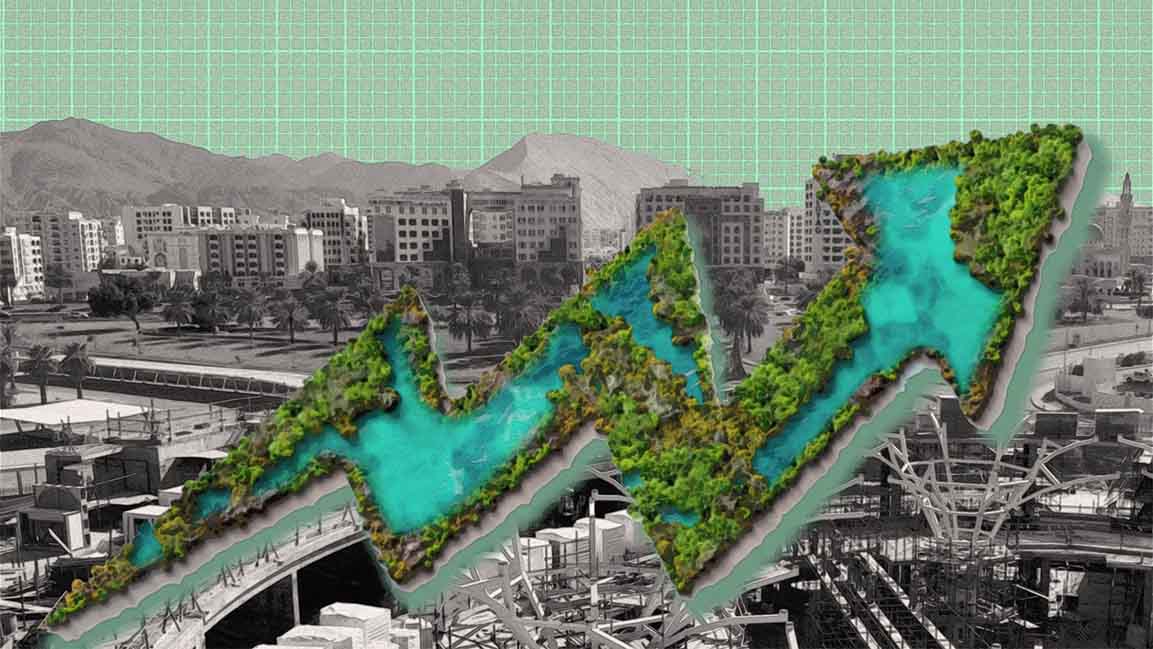

Oman prepares to get green financing to take off

The Central Bank of Oman’s latest report pushes the sustainable finance agenda.

Now accepting applications for Fast Company Middle East’s Most Innovative Companies. Click here to apply.

Climate change raises possible risks on both the micro and macro scale for the financial system. A report notes that this comes in direct physical shocks and risks from transitioning to a low-carbon economy.

With this, The Central Bank of Oman (CBO) has prepared a roadmap that looks to pivot sustainable and green financing within the domestic financial system.

The CBO has advised banks and financial leasing companies to enhance their risk management policies as part of these efforts.

“CBO is actively encouraging financial institutions to develop policies that facilitate and promote green financing,” stated the CBO’s Financial Stability Report (FSR) 2023. It added that the bank is working towards increasing analytical capabilities to manage climate-related risks better.

Furthermore, the report says embracing new technology is also crucial for the financial sector. Although Oman has not experienced any risks with cybercrime recently, the Omani financial sector has its vulnerable risks.

“Cybersecurity remains a top strategic priority for CBO. Despite the increased demands on payment and settlement systems (PSS) since the pandemic, Oman’s PSS infrastructure has remained resilient and robust,” said the report.

The CBO has also established task forces that study Central Bank Digital Currencies, among other digital innovations.