- | 11:00 am

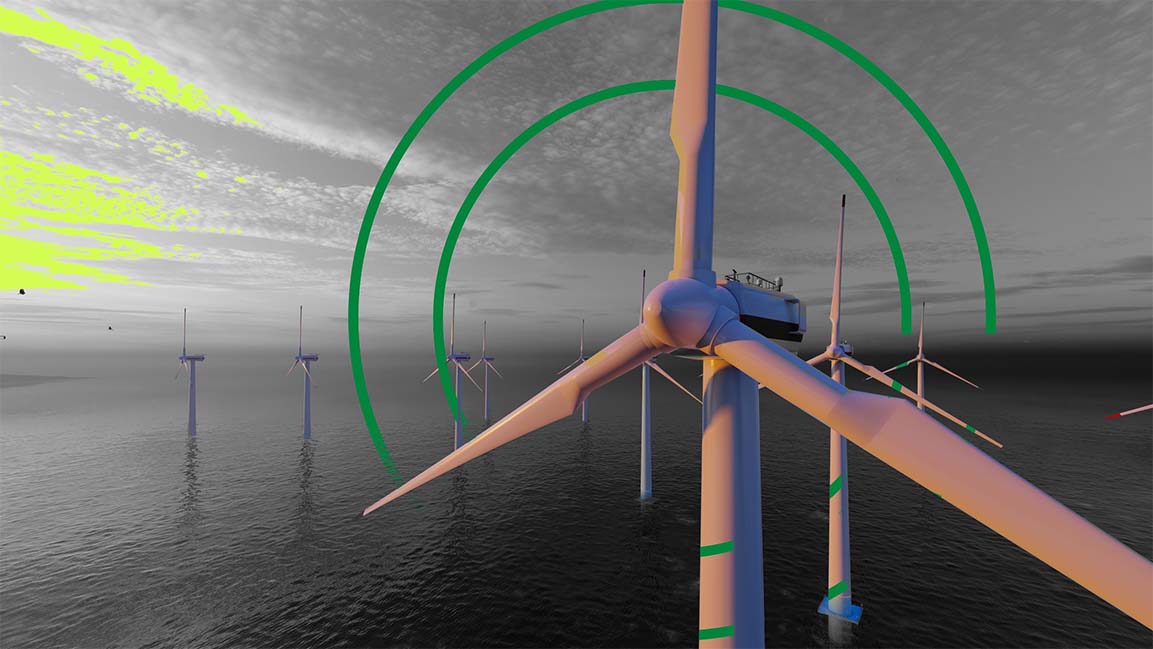

PIF buys stake in German offshore wind developer Skyborn

The Saudi wealth fund also invested in renewable energy companies such as ACWA Power and the Sudair and Al Shuaibah Solar Energy projects

Of late, the Saudi sovereign wealth fund PIF (Public Investment Fund) has been making significant investments in renewable energy companies, including ACWA Power and the Sudair and Al Shuaibah Solar Energy projects. Through investments in E1 and Lucid Motors, the $620 billion fund is also developing electric vehicles.

Now, to accelerate its energy transition journey on a global scale and expand its global asset portfolio, PIF has acquired a 9.5% stake in Skyborn, a leading German offshore wind developer and operator, alongside Global Infrastructure Partners (GIP), an independent infrastructure investment fund.

Announcing the key stake deal, PIF said the investment in Skyborn was in line with its mission to build strategic economic partnerships to achieve sustainable returns and unlock promising economic opportunities globally.

“Offshore wind has a key role to play in driving global decarbonization, and we see significant growth opportunities for Skyborn,” said Turqi A. Alnowaiser, deputy governor and head of the international investments division at PIF.

The PIF is working to meet Saudi Arabia’s commitment to developing 70% of its power needs through renewable energy by 2030 as the kingdom strives to meet its net-zero target by 2060.

“We are excited to have one of our most important investor partners, PIF, invest alongside us in Skyborn Renewables. The investment supports our commitment to the energy transition through the continued growth of global renewable power generation,” said Matt Harris, founding partner at Global Infrastructure Partners.