- | 2:00 pm

These are the key trends that will shape financial services in next five years

Investments in fintech are expected to grow at a compound annual growth rate of 17.2% from 2022 to 2030, reaching $949 billion.

Now accepting applications for Fast Company Middle East’s Most Innovative Companies. Click here to apply.

The global financial services industry is still being transformed by the wave of innovation sparked during the pandemic.

Customers now expect convenient and personalized services, leading to increased competition and continuous disruptions as new players such as fintech and big tech companies enter the market.

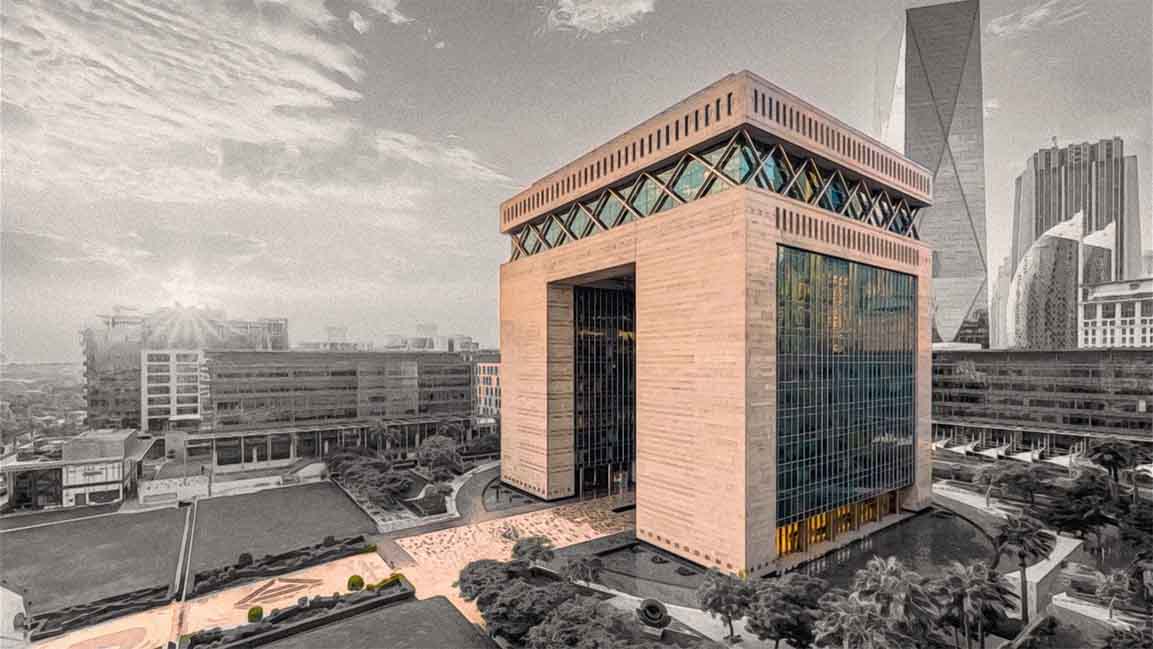

The Dubai International Financial Centre (DIFC) and Refinitiv, a London Stock Exchange Group business, have released a report titled Drivers of Innovation in Financial Services. The report provides a five-year outlook for innovation in the financial services industry.

Technology such as artificial intelligence (AI), blockchain, and cloud computing drives business models and product innovation.

This has led to reduced operating costs and more efficient processes. Investments in fintech are expected to grow at a compound annual growth rate (CAGR) of 17.2% from 2022 to 2030, reaching $949 billion.

This accelerates the pace of fintech innovation globally and in Dubai, offering access to high-growth emerging markets in the Middle East and North Africa (MENA), Western Europe, Asia, and Africa.

“Innovation in the financial industry has become more important than ever with the continuous and fast pace of disruption in the industry pushing all players to find new ways of doing business,” said Nadim Najjar, Managing Director, CEEMA, London Stock Exchange Group.

“FinTech has been a cornerstone for financial innovation in recent years, introducing a growing range of new technologies that enable new business models, applications, processes, or products,” she added.

“We already see financial institutions actively joining forces with disruptive startups as we collaborate to shape the future of finance in line with our 2030 strategy and beyond,” said Arif Amiri, CEO of DIFC Authority.

The report identifies four key trends that will be pivotal in shaping the financial services industry over the next five years. The first is open finance, a new paradigm for financial services that gives customers and businesses more control over their financial data and the ability to share it with third-party providers.

The second trend is decentralization, which refers to the shift away from centralized financial institutions and towards more distributed and peer-to-peer systems, driven by the rise of blockchain technology and cryptocurrencies.

Next comes digital assets such as cryptocurrencies and non-fungible tokens (NFTs), which are emerging as a new asset class. This is creating new investment opportunities and challenges for financial institutions.

Finally comes ESG considerations, which investors and financial institutions are increasingly considering. This is driving innovation in sustainable finance and responsible investing.