- | 2:00 pm

This partnership aims to offer quick and cost-effective international payment services

Wio and Wise aims to simplify banking and transform the international payments experience for businesses as they accelerate into the digital age.

In the banking industry, one size doesn’t fit all. Increasingly, customers need services that fit their business case. To this end, digital banks have a big opportunity to develop customized customer journeys.

“We can provide relevant tools so that customers can focus on growing their business and offer the right information and insights to enable companies to make better decisions for their business and financial health,” says Jayesh Patel, CEO of Wio Bank.

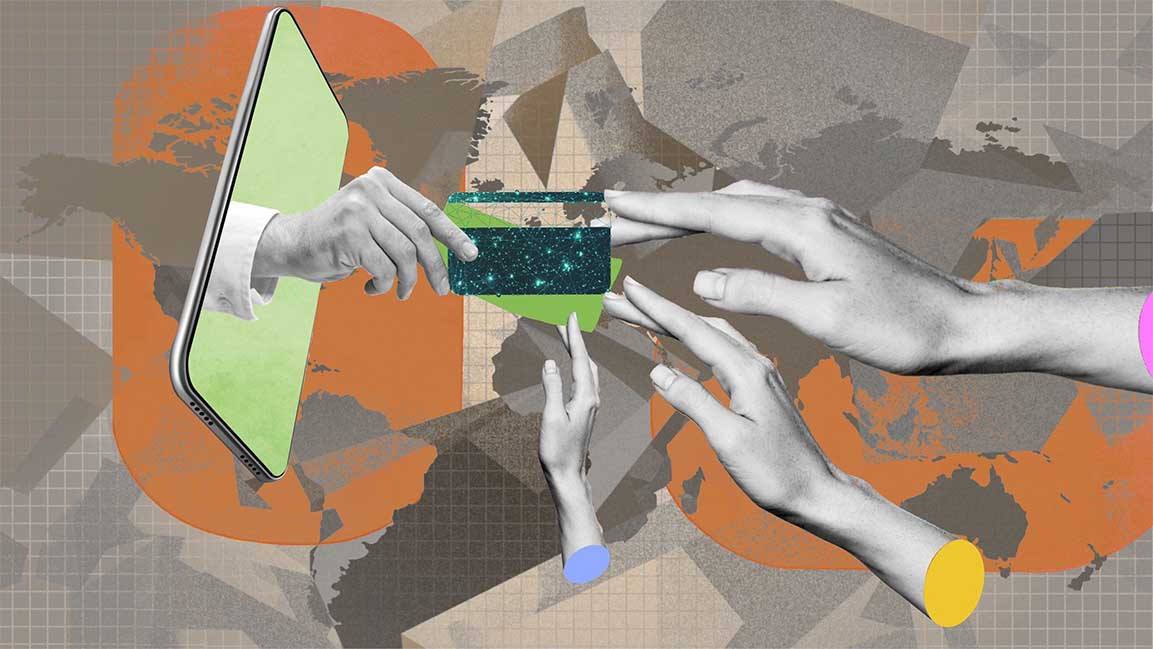

Due to a surge in ecommerce, B2C payments, and web-centered businesses, international transactions increased, from $29 trillion in 2019 to around $39 trillion in 2022. In the face of this increased demand, businesses are turning to their banks and fintech partners for solutions that make payments more instant, secure, and transparent—to help them remain competitive in the global marketplace.

Keeping this broad trend in mind, Wio, the region’s first platform bank, now plans to partner with Wise, a UK-based fintech giant, to allow businesses to access quick, transparent, and cost-effective international payment systems.

According to Patel, through this partnership, Wio Business, the digital banking application, customers can instantly make international money transfers at the cheapest rates in the UAE. “We want to build on our commitment to enable greater access to financial services for our clients.”

Similarly, Kristo Käärmann, Co-Founder and CEO of Wise, says this partnership is vital to transform the international payments experience for businesses as they accelerate into the digital age. “People are living evermore international lives, and they need financial services that can keep up.”

It is Wise’s mission, says Käärmann, for money to move instantly, conveniently, transparently, and, eventually, for free worldwide. “Partnerships like this help us get closer to making this a reality.”

“We have spent more than a decade trying to improve international transfers, and we have 4,000 people working on the problem today. Banks cannot devote this resource to the problem, as they are domestically focused and have a long list of other priorities,” adds Käärmann.

Since it was launched earlier this year, Wio has partnered with services providers and business-to-business payment platforms. The range of new partners is a testament to its flexibility, ease of integration, and relevance to businesses from across industries.

“We are currently in the process of signing partnerships with several e-commerce platforms and will soon enable our partners to offer core financial services on their platform through advanced API integration,’ says Patel.

“We aim to simplify banking and provide customers with a seamless, intuitive, and intelligent experience. A big part of this is directed towards accessibility and customized services,” he adds.

FUTURE OF OPEN AND DIGITAL BANKING

Talking about the future of open and digital banking in the Middle East, Patel says embedded finance will play a bigger role as it will offer customers the utmost flexibility and ease. “Imagine having access to banking in everyday apps and not having to visit a branch. This is a game-changer for the Middle East business community, and we look forward to being at the forefront of this.”

As the banking industry continues to build on the digital momentum to improve the banking experience, irrespective of the channel, Patel plans to grow Wio across three business lines – digital banking apps, embedded finance, and Banking as a Service (BaaS).

“Our goal is to ensure that the products and services we introduce directly answer customers’ needs,” says Patel. “We want to integrate all financial products into non-financial platforms, which a banking platform in the region has not yet explored.”

“We have prioritized the SME community with the launch of the Wio Business. The app will enable access to banking and business services conveniently and seamlessly by offering many financial and non-financial services and tools that will support businesses in their journey towards success,” adds Patel.

Meanwhile, Käärmann says building the best product is imperative to keep up in a competitive fintech market. “If your product is ten times better than that offered elsewhere, you’re in a good position. Building that product requires a clear understanding of the problem you’re solving, and you need talented, committed people and a willingness to go out and solve it.”