- | 10:00 am

Forget unicorns—investors are looking for dragons

‘When founders inform me that they are building the next unicorn, I find myself urging them to focus on creating an invincible, tenacious ‘dragon’ instead.’

We’ve long since passed peak unicorn. From a high in 2021, in which 537 private technology-enabled companies valued at $1 billion or more were born—a record number in a record year for venture capital—2022 saw the unicorn production line stall dramatically. According to CB Insights, just 25 new unicorns were created in the most recent quarter (Q3 2022), the fewest since Q1 of 2020. I don’t expect their birth rate to recover anytime soon.

While this steep decline is hardly surprising amid a sharp downturn, where valuations have collided with reality and VCs are keeping their powder dry, I believe it’s also a good thing for the wider industry. So much so that when Techstars founders inform me that they are building the next unicorn, I find myself urging them to focus on creating a “dragon” instead.

Why? First, much like the notion of completing 10,000 daily steps for health purposes turned out to be more marketing accident than legitimate science, billion-dollar valuations were always an arbitrary milestone. A handy peg and usefully round number for PR and investors, certainly, but essentially irrelevant when assessing a company’s genuine long-term value.

Indeed, in the cold light of day, many so-called unicorns (if you’ll forgive the mixed metaphor) turned out to be little more than one-trick ponies that VCs, flush with cash, had dressed up and flattered with outlandish valuations and often extravagant backstories, hoping they would be mistaken for those rarest of creatures come an exit.

Besides, being a unicorn in this market no longer even guarantees a clear path to liquidity. The tech IPO market is currently all but frozen, which means that when a supposed unicorn is unprofitable—as many of them are behind the smoke and mirrors—its billion-dollar status is merely a theoretical/paper valuation. That will inevitably lead to more WeWork-style implosions and public market flameouts.

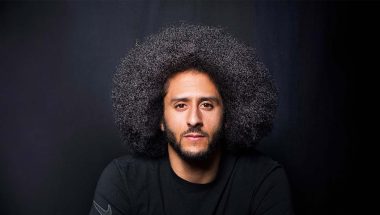

Second, the allure of becoming a unicorn for the power it confers, and the buzz and hype it creates, has led founders, urged on by VCs, to go for broke and damn the consequences. This blitzscaling, scale-at-all-costs approach rewards entrepreneurs who “move fast and break things” for cutting corners, ignoring regulators, or allowing small, nagging problems to accumulate and fester. And sometimes all three.

This has resulted in some highly damaging outcomes. From the cult of the “superstar founder”—where egomania runs riot and a company culture turns toxic—to the poisoning of public discourse and divisions sowed across society, the disastrous consequences on employees, individual users, and the wider world are well-documented.

Furthermore, pursuit of unicorn valuations has also led companies to de-prioritize business fundamentals, and figuring out a sustainable business model in favor of spending more to add customers/users than those customers return in revenue, meaning that they are just burning their investors’ money. Hardly the recipe for long-term success.

And then there’s the word unicorn itself (not to mention its paddock of offshoots such as decacorn, centicorn, soonicorn, and futurecorn). In recent years, the term has become ubiquitous both in media coverage of tech and within the industry. However, it’s not only misleading in a valuation sense, but also in its connotations. Although it was coined to convey scarcity, the word also conjures up images of fluffy, fairytale creatures surrounded by rainbows, butterflies, and sprinkled stardust—leading to an “everything-is-awesome” outlook, which is the polar opposite of the reality of entrepreneurship.

As anyone who has been a founder will tell you, founding and running a startup is like sprinting a marathon. Should you be one of the lucky 25% or so of VC-backed startups to succeed, it will entail a decade of hard graft in the mud and weeds without a rainbow (or a butterfly) in sight. To imply otherwise is simply irresponsible.

All of which brings me back to why early stage investors like Techstars increasingly prize another breed of mythical beast instead: dragons. Their shared mythical status aside, dragons—unlike unicorns—are also independent, tenacious, yet nimble, and, above all, pretty much invincible.

Whereas unicorns’ primary defense is often spending VC money to win and retain market share through price wars and outgunning competitors, dragons build genuine defensive moats and, therefore, real-world resilience. They keep a tight grip on spending, ensure underlying business rigor, have a long-term sustainable vision and pursue pathways to profitability as opposed to scale for scale’s sake.

When combined with fair valuations—which remain realistic for seed-stage companies, which have avoided the frothiness of the late-stage market—dragons are now a very attractive proposition for investors, especially in a downturn. Yes, both are figments of human imagination. But for me, dragons slay unicorns every time.