- | 9:00 am

This is how the gaming industry is tackling censorship in the Middle East

Censorship is one way to go, but what about developing local games?

The Middle East’s video game market is one of the world’s biggest. About 60% of the region’s population consider themselves gaming enthusiasts, accounting for half of gaming app downloads, more than the global average of 40%, according to a Boston Consulting Group report. Unsurprisingly, international developers want in on it – but its rules on what is acceptable are growing increasingly strict.

Game censorship is not a new phenomenon. “Its history goes back almost as early as game development itself,” says Hamid Mukhtar, an associate professor in the School of Computer Science at the University of Birmingham Dubai.

Mukhtar cites the first violent game as an example, dating back to 1976 when Exidy Games released Death Race 2000, requiring players to drive a car over stick figures and stirring a public outcry. Similarly, in 1980, Berzerk, a shooting game, resulted in a player passing away from a heart attack while playing the game, the first recorded case of a death caused by video gaming.

For these reasons, and many others, games go through censorship before being released publicly. In the Middle East’s two most prevalent gaming markets, Saudi Arabia and UAE, many games have been censored or banned due to content not meeting the regulatory guidelines involving certain values, morals, legislation, or vulnerable audiences.

One such instance is that of Roblox, which, prior to its new age categorization, was banned in both the UAE and Saudi Arabia in 2018 due to content deemed harmful for children, and later lifted. However, despite Roblox’s new age classification, the platform still has restrictions on obscenity, depictions of animal abuse, extreme violence, and regulated drugs besides alcohol.

Spec Ops: The Line was another case in point, as the UAE banned the game due to a bad depiction of Dubai in a sandstorm and state of destruction. This ban went as far as issuing the TRA to block the game’s official website and preventing distribution throughout the GCC and the Levant countries of Lebanon and Jordan.

Other games, such as The Last of Us Part II, have been banned in UAE and Saudi Arabia due to same-sex content.

“Ultimately, any global games publisher needs to operate in line with platform guidelines, rating bodies, and national legislation, as well as making every effort to be respectful of the cultures in the countries in which they have a presence,” says Mikka Lindgren, VP, publishing of Saudi-based international gaming company, Sandsoft.

A “significant” market for core and casual gamers, with Saudi Arabia representing a value of more than $1.8 billion, how do the countries maintain a balancing act in regulating gaming content?

UNDERSTANDING THE MARKET

First and foremost, it can be helpful to understand what genre of games and which platforms gain the most attention among users in the Middle East.

One factor is that different age groups are attracted to different game genres, with teenagers leaning more toward role-playing social games. As they grow older, they prefer more strategic, solo games, says Mukhtar.

Not every consumer market involves the same gaming technologies either. “In Saudi Arabia, Xbox and PlayStation are popular gaming devices, followed by powerful gaming PCs with state-of-the-art GPUs. The gamers using these gadgets are more engaged in MMORPG (Massively Multi-player Online Role-Playing Games) with long gaming hours in front of screens every day, and they also spend money on in-game purchases,” adds Mukhtar.

In contrast, the UAE’s gaming market involves more mobile games as most expats lead busy lives, constantly on the go. “Mobile games cater to their need for entertainment during short breaks or commutes.”

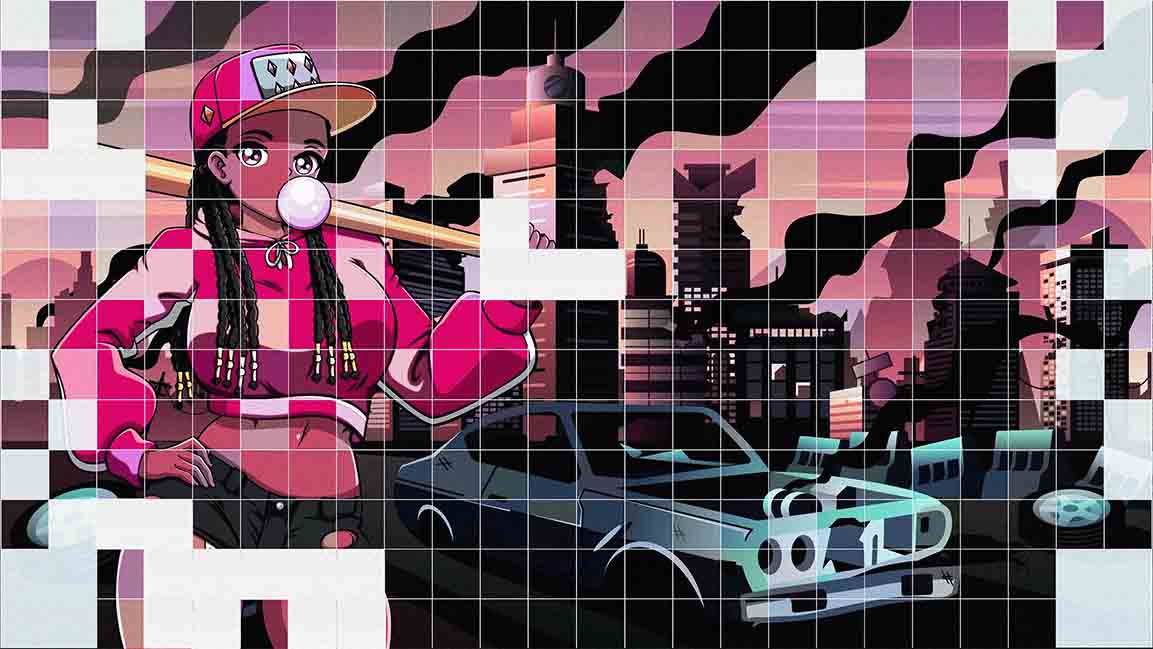

Looking at gaming charts on Google Play or the App Store, the top trending games in the UAE are Ludo, Subway Surfers, and Candy Crush. For Saudi Arabia, the focus is more on games such as PUBG, Fortnite, FIFA, and Grand Theft Auto.

Lindgren, who has had 25 years of experience in the mobile gaming space before joining Sandsoft, explains that the Middle East has traditionally been a console-first market, with mobile gaming slowly dominating the field.

“There are some clear regional preferences, such as for digital versions of traditional tabletop or card games such as Ludo. Other popular genres include strategy, shooters, sports, driving, and racing. A common denominator for most successful titles is social or competitive gameplay. Good games have universal appeal, but it’s fascinating to see demand for certain games like Ludo or Dominos, which are shaped by cultural preferences,” says Lindgren.

Paul Dawalibi, the host of CNBC Arabia’s Game Changers and CEO of Holodeck Ventures, echoes this sentiment, sharing that sports-related games are also gaining traction among gamers. “We see lots of success with games like PUBG Mobile. Sports games are also highly accessible and relevant because of existing fanbases of the underlying sport, hence the popularity of FIFA.”

THE QUESTION OF CENSORSHIP

The UAE’s National Media Council (NMC) has a list of guidelines that balances content and digital expression for the country. The rules seek to “ensure that media material respects the religious, cultural and social values of the UAE, all the while promoting freedom of expression and constructive dialogue,” which Saudi Arabia’s General Commission for Audio-Visual Media has in common.

“Awareness of what is accepted about violence, sex, or alcohol is part of the consideration in each market. There are age rating rules in KSA and UAE that set the standard for most of the Middle East, and all games need to obtain a rating, just like in Europe with PEGI and in the US with ESRB,” says Lindgren.

He adds that trouble with the authenticity of games, despite regulation and censorship, is more of a factor for PC and console games, which often depict realistic graphical content.

On the other hand, mobile gaming is a more accessible platform, including all audiences, prioritizing fun gameplay and involving simple mechanics. “A simple change to clothing or tweak to character model can be all needed. In the mobile space, advertising content with fake gameplay or nudity is more likely to be unsuitable than the game content itself,” Lindgren says.

Changing a video game often involves a whole different level of difficulty. Facing the prospect of such expensive and time-consuming reworks, many developers decide it’s not worth the trouble. Although some, enticed by the promise of hundreds of millions of players, go back to the drawing board.

As for international games that are trying to receive approval for the Middle Eastern markets, Lindgren suggests that working with a local publishing partner along with the relevant rating bodies can help make the small changes necessary.

Due to the different laws across the Middle East, Mukhtar mentions that it may be simpler to avoid the need for censorship at all and for “developers to consider the stricter subset of all the laws and policies applicable to all the countries.”

However, in the same way that movies, music, or books are regulated in the region and remain forms of entertainment, games should be the same. “Censorship or regulation of any kind, though, shouldn’t be heavy-handed and shouldn’t take away from the game’s fun. It should just exist to protect the important value system in this region,” says Dawalibi.

Mukhtar also adds that developers having regard for local censorship rules and considering the guidelines promote inclusivity and can attract a larger audience.

THE POWER OF LOCALIZATION

The Middle East needs to get past the game censorship bump, and localization could be a solution, say experts, but it’s challenging.

“Considering the growing market, Arabic language support is highly desirable in most of the games,” says Mukhtar.

Games with themes based on historical events, folklore, or local mythology are more popular and appealing to the local audience than sci-fi and modern warfare games.

“Developing content for the local market requires units or teams ranging from artists, designers, writers, and engineers to producers and directors who are familiar with the local market and the preferences of the audience,” adds Mukhtar. Finding the talent and trained professionals to do so presents even more of a challenge in the Middle East.

Another aspect to consider when localizing games is the availability of local servers. “Local servers often don’t exist in the region. Competitive multiplayer games struggle to gain traction if players can’t compete on an equal footing with low ‘ping’ and a quality gaming experience,” says Dawalibi.

BCG’s Drivers of Global Gaming Industry’s Growth 2023 reports that localized content is important for industry growth. It provides the example of Chinese publisher Tencent, which has a headquarters in Abu Dhabi , releasing an Arabic version of PUBG Mobile in the region, gaining popularity in the Middle East and ranking as one of the top five in mobile app downloads in Saudi Arabia and top three in UAE.

Launching gaming companies like Sandsoft helps push the localization agenda. Lindgren says that Sandsoft’s vision is to publish global gaming content with local relevance, focusing on “creating routes for young people to follow their passion into gaming.”

“The population here is young, digital savvy, and has significant disposable income, perfect from a gaming industry standpoint,” says Dawalibi.

These efforts can also be seen through Saudi Arabia’s National Gaming and Esports Strategy plans to create 40,000 jobs and develop 30 games by 2030. In the UAE, AD Gaming and DMCC Gaming Center have launched to support local talent while attracting global businesses.

In the end, the main driving factor is interesting gameplay. And as the region becomes more dominant in the global market, developers will probably start censoring themselves from the outset, altogether avoiding themes that might offend the region’s culture.