- | 11:00 am

Your thinking about ESG is all wrong. Here’s what it’s really about

Blaine Townsend, director of Bailard Wealth Management says attacks on ESG lean heavily on false economics and myths.

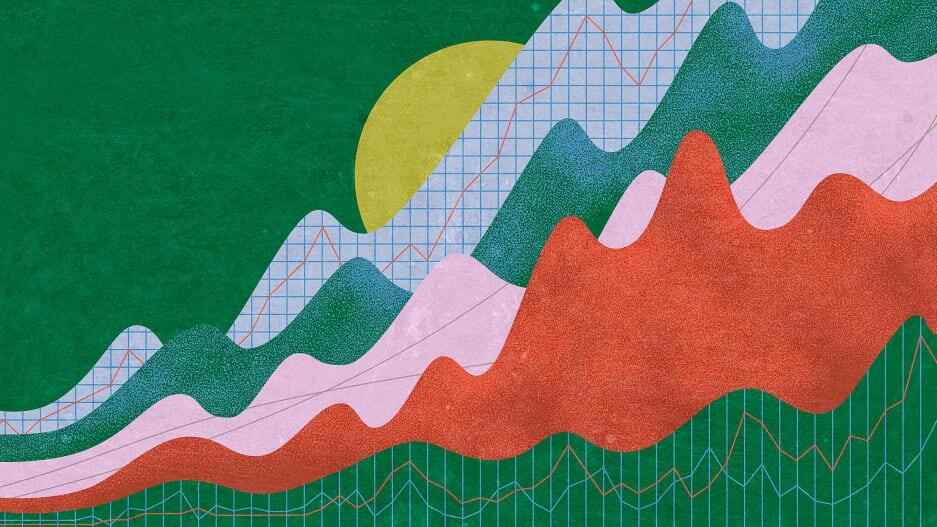

The demand for environmental, social, and governance (ESG) investing over the past decade has been so great that even the term’s opacity did not deter growth. By the end of 2021, one in eight dollars of professionally managed assets in the U.S. used self-reported ESG criteria—totaling to $8 trillion in assets under management.

With that unmitigated traction in the market, two predictable things have happened. First, large asset managers rode the wave to effectively gather assets. This brought with it the specter of greenwashing. Second, those whose policies or industries were threatened by ESG’s growth went on the attack.

Both issues will drive the ESG narrative in 2023 and beyond. The greenwashing issue is timely and legitimate. ESG has always been hard to define, and better disclosures and classification of ESG-related funds are an absolute necessity for the consumer going forward.

The political attacks against ESG, on the other hand, come from a more virulent place and are intended to have a chilling effect on growth. Suggesting there is long-term risk in things such as labor practices or climate, or that energy transition can add jobs and growth, seems to be a popular trigger on ESG in Washington.

ANTI-ESG LAWS: THE GREAT CONFLATION

Pushback from policymakers on ESG are conflating certain social issues in society with ESG investing. But ESG is not about ideology; rather, ESG is about data. Attacks on ESG lean heavily on false economics and myths. They treat energy transition as a zero-sum game instead of something transformational, and practices as intuitive as attracting and retaining good workers as an agenda item rather than as a metric of good business.

Anti-ESG laws can be ideological in and of themselves. In Texas, for example, lawmakers have created a less competitive underwriting market for their municipal bonds by prohibiting certain banks based on their climate or guns policies—two issues that often fall into an ESG rubric. These laws may have already cost Texas taxpayers $300 to $500 million through a less-than-competitive bidding process for bonds. In fact, Texas is now getting worse terms for its municipal bonds than California, which actually has a lower credit rating. Now Florida is working to follow suit, against the economic best interests of its state and its taxpayers. And yet, some argue that ESG managers are ignoring financial returns for ideology.

ESG grew precisely because it focused on enhancing the risk and return tradeoffs in portfolios. But politics are about risk and return, too. In fact, the current attacks are right out of an old playbook that has already failed to stem the growth of ESG.

For instance, an excerpt from a 2005 American Enterprise Institute publication bears a strikingly familiar resemblance to the current anti-ESG platform of 2023:

Should we encourage public pension funds to boycott tobacco companies . . . or natural resource firms that do not embrace global-warming initiatives, even though a boycott would have no discernible impact on the operations or profits of these companies but would risk devastating the returns of pensioners who often have little say in what’s being done in their names?

While nearly 20 years has past, not much has changed other than that the debate has moved from the halls of think tanks to the halls of Congress and the media.

ANTI-ESG LAWS ARE A SOLUTION LOOKING FOR A PROBLEM

There are already laws to govern fiduciary duty. The Employee Retirement Income Security Act (ERISA) has been a law overseeing retirement funds since 1974, for example, and the Department of Labor (DOL) has rules which clarify how ESG integration can be handled in plan management.

Neither the ERISA nor the DOL prohibit or mandate whether ESG should be part of a plan’s investment process. But they do not absolve fiduciary duty for plans that utilize ESG either. If a pension fund investment committee uses managers that integrate ESG, they must still comply with laws as a fiduciary.

Asset management is a fierce industry, and the risk and return characteristics of an ESG portfolio are always under scrutiny. There are well-known and understood performance benchmarks to evaluate managers. Pension funds are filled with highly experienced, educated, and credentialed professionals. They can hire and fire managers without a politician telling them how to do it. And they are subject to current laws if they fail in this charge. If a manager underperforms, they will get fired without a politician being involved—whether they integrate ESG or not. That is how things work in the real world.

Professional investors don’t see ESG as an ideological movement. Nor do many activist groups working on social or environmental issues. Which is why ESG gets attacked from the sustainability movement as well . . . for being too capitalistic or moderate. They do not believe that ESG is any better than Wall Street in protecting the planet or people. This is at the heart of the greenwashing debate. This too has been around for decades.

In fact, you would have seen headlines the same as today’s commentary in 2005: “Are green funds true to their colors? Socially responsible mutual funds have become big business in recent years. But some of their holdings may surprise you.”

Such headlines did not come as a result of regulatory scrutiny. Or scrutiny from financial intermediaries or right-leaning politicians. These rebukes originated from Paul Hawken, a sustainable business leader and coauthor of Natural Capitalism (Hawken, Amory, and Hunter Lovins). Hawken’s penned a scathing inditement of the traditional SRI mutual fund industry, writing under the auspices of his Natural Capital Institute. It gained a great deal of attention.

His thesis could be summarized by one statement that mirrors those being made today by investors worried about greenwashing: “(SRI) has no standards, no definitions, and no regulations other than financial regulations. Anyone can join; anyone can call a fund an SRI fund.”

Socially responsible investing was one of the predecessors of modern ESG. Since SRI was supplanted as the standard bearer in the market, much has been made about the divergence in methodology and lack of correlation of uniform ESG ratings. However, with voluntary reporting from companies providing the bulk of ESG data, uniformity was never going to be a likely outcome. This is why greater required disclosures by regulators is absolutely key. The growth in assets managed under the “ESG” banner no longer makes this optional. The Capital Markets have voted. ESG is seen as having value. Better regulation needs to be developed.

For now, ESG is stuck in the middle of both a political and ideological debate. As are many ESG asset managers. Blackrock, which is the world’s largest asset manager and largest ESG manager, is being targeted by Florida and Texas for their fossil fuel-free strategies, while also being targeted by environmental groups for “investing in climate destruction.” Neither critique is spot on.

Regardless, data, not ideology, drives ESG. Pensions funds are interested in what this data brings to the table. They are long-term investors and want to understand the world beyond the next three months of quarterly earnings. They also are fiduciaries and held to that standard already. They don’t need politicians intervening in the free market. Good managers will succeed (whether they integrate ESG or not). This is what makes markets. It just might not sound as good online or on the campaign trail.