- | 8:00 am

4 ways 2023 could be a big year for clean energy

From offshore wind farms to growth in the electric vehicle market, here’s what to watch out for in the clean energy space this year.

This article originally appeared on Inside Climate News. It is republished with permission. Sign up for their newsletter here.

In 2023, the country’s first super-size offshore wind farms will come online, or at least get close to it. U.S. sales of electric vehicles will continue to accelerate, likely hitting 1 million units per year for the first time. And state lawmakers in Maryland, Massachusetts, Michigan, and Minnesota are poised to pass climate and clean energy legislation.

Meanwhile, the most significant event for the clean energy economy in 2022—the Inflation Reduction Act—is going to have reverberations throughout 2023 and beyond as federal agencies work to implement the law and consumers and companies begin to see its benefits.

That’s a lot. And that’s just the top of my list of what to watch and expect this year.

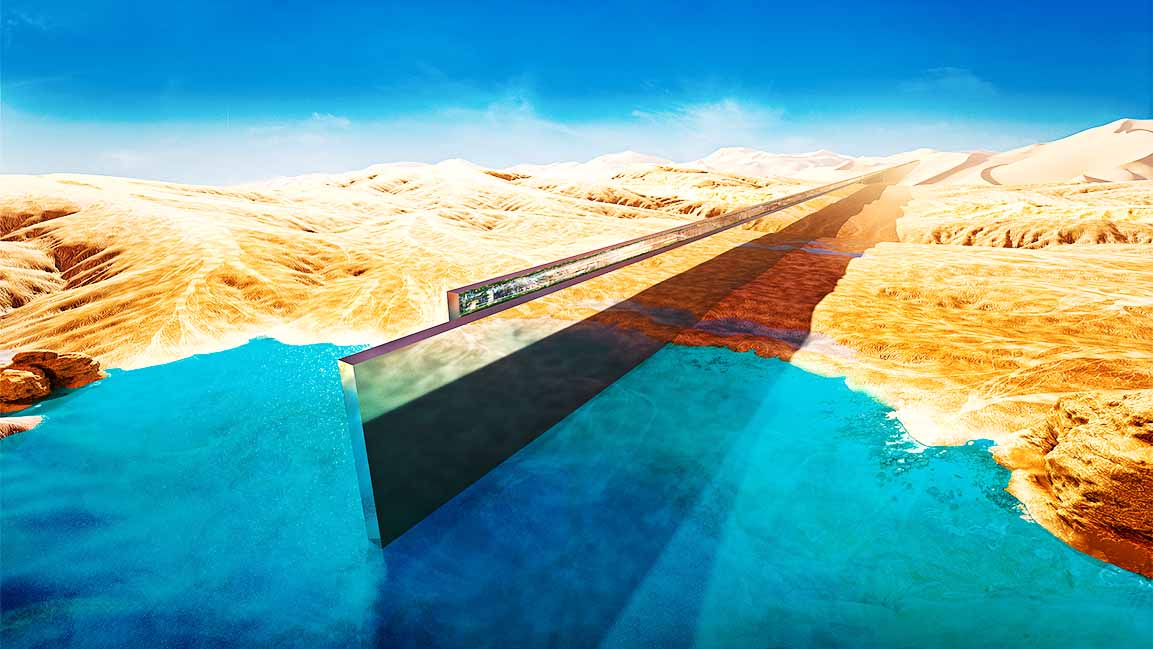

OFFSHORE WIND GETS REAL (AND WE MEAN IT THIS TIME)

The U.S. has two operational offshore wind farms, one each in Rhode Island and Virginia, with a total of seven turbines and capacity of 42 megawatts—barely a blip in our electricity system.

By the end of the year, the first of a new generation of gigantic offshore wind farms should be online or close to it. Vineyard Wind 1 off of Massachusetts, with 800 megawatts, and South Fork Wind off of New York, with 132 megawatts, are both under construction.

Another 5,400 or so megawatts are right behind and are on track to finalize financing or begin construction in 2023, according to BloombergNEF.

I’ve been writing for years about how U.S. offshore wind is about to make a leap to become a major source of emissions-free electricity, and also about the delays and frustrations that have made this moment tardy for its arrival.

Developers are eager to finally begin generating megawatt-hours. They also are facing challenges as inflation has increased the costs of equipment and labor. For example, the developer of Commonwealth Wind, a 1,232-megawatt project being developed off of Massachusetts, has sought to renegotiate contracts with the state government to reflect the increase in costs. So far, regulators are insisting that the company stick with existing contracts.

This mix of progress and challenges will shape an eventful year for this burgeoning energy sector, said Chelsea Jean-Michel, an analyst for BloombergNEF.

“Perhaps a good way to categorize the current state of the U.S. offshore wind market is that it is in its preteen years,” she said in an email. “While construction for early-stage projects is underway, seabed lease auction activity has been soaring, and more project approvals are imminent, the country still has only seven turbines spinning off its coasts. Prospects for the sector are high, but rising costs have hit some projects and there may be further growing pains as the U.S. scales up its domestic supply chain and realizes its first big projects.”

Offshore wind is a potentially important part of the electricity mix, because it can provide power to coastal population centers that aren’t close to the large open spaces that are best suited for building onshore wind and solar.

But like just about any technology in its early stages, offshore wind is expensive compared to more established electricity sources. Developers and government officials are betting that the industry’s growth will lead to economies of scale that drive down costs.

THE EV ECONOMY CONTINUES ITS RAPID RISE

As I was driving from Ohio to Iowa last month for Christmas, I noticed more electric vehicles than ever before. Lots of Teslas, Rivians, and others.

This tracks with the broader trend of rapid growth in EV sales, a trend that auto analysts are predicting will continue.

“The battery-electric vehicle market continues to outpace the overall market in sales, and a new milestone is on the horizon: 1 million EVs sold in the U.S. in 2023,” analysts for Cox Automotive said last month in an essay with predictions for the new year.

The prediction of 1 million units sold is a pretty safe one. In 2022, automakers sold 576,408 EVs in the first three quarters, despite severe constraints in the availability of some models because automakers had difficulty obtaining parts.

The market is going to grow due to the combination of increased availability of existing models and the debut of 30 or so new models.

One of the big sellers should be the Ford F-150 Lightning pickup. The model was available in 2022, but the supply was much less than demand as Ford worked to ramp up production.

Among the new models that could be big sellers: the Chevrolet Silverado EV, the Tesla Cybertruck, the Hyundai Ioniq 6, and the Nissan Ariya.

The gasoline version of the Silverado is one of the most popular vehicles sold in the U.S., behind the F-150 and Ram 1500.

General Motors is making the debut of the Silverado EV a focal point of its larger shift to electric vehicles. Some versions of the model should go on sale in the spring as part of a gradual rollout. (Car and Driver has a rundown of the model’s features, including a range of up to 400 miles, and AutoBlog has some recent spy shots of the model during testing.)

Ram also is entering the fray with an electric version of the 1500, but it won’t be available until 2024.

This sets up one of the most intriguing subplots in the EV market, as the makers of the best-selling pickups compete on price and features to gain an advantage in the market to come, and as EV-only brands also vie for attention and sales.

OFF TO THE RACES IN MARYLAND, MASSACHUSETTS, MICHIGAN, AND MINNESOTA

In the 2022 elections, Democrats gained control of the governor’s office and both chambers of the legislature in four states: Maryland, Massachusetts, Michigan, and Minnesota.

Based on examples from other states, we know that a Democratic “trifecta” is a strong indicator that a state is about to pass major climate and clean energy legislation, as Inside Climate News reported right after the election.

It helps to view the four states as two pairs with some common traits.

In Maryland and Massachusetts, newly elected Democrats are replacing Republicans in the governor’s office and will be working with existing Democratic majorities in the legislature. The new governors will be eager to enact their agendas at the same time that legislative leaders will move swiftly to take actions that they couldn’t under GOP governors. It’s a formula that could lead to substantial action right away.

In Michigan and Minnesota, Democrats have gained narrow majorities in the legislature to go along with the reelection of Democratic governors. While the governors and some legislators may want to pass major climate and clean energy legislation, it remains to be seen what can pass in these chambers where leaders and new members are still figuring out what’s possible.

The result in Michigan and Minnesota may be climate and clean energy legislation that is more substantial than anything passed in those states before, but still not as far-reaching as what we could see in Maryland and Massachusetts.

THE CHALLENGE OF IMPLEMENTING THE INFLATION REDUCTION ACT

The Inflation Reduction Act barely passed last August, following a prolonged period in which it looked like nothing would pass. After that suspense, the implementation phase is much less exciting—but this is the part that determines whether this ambitious law can live up to its promises.

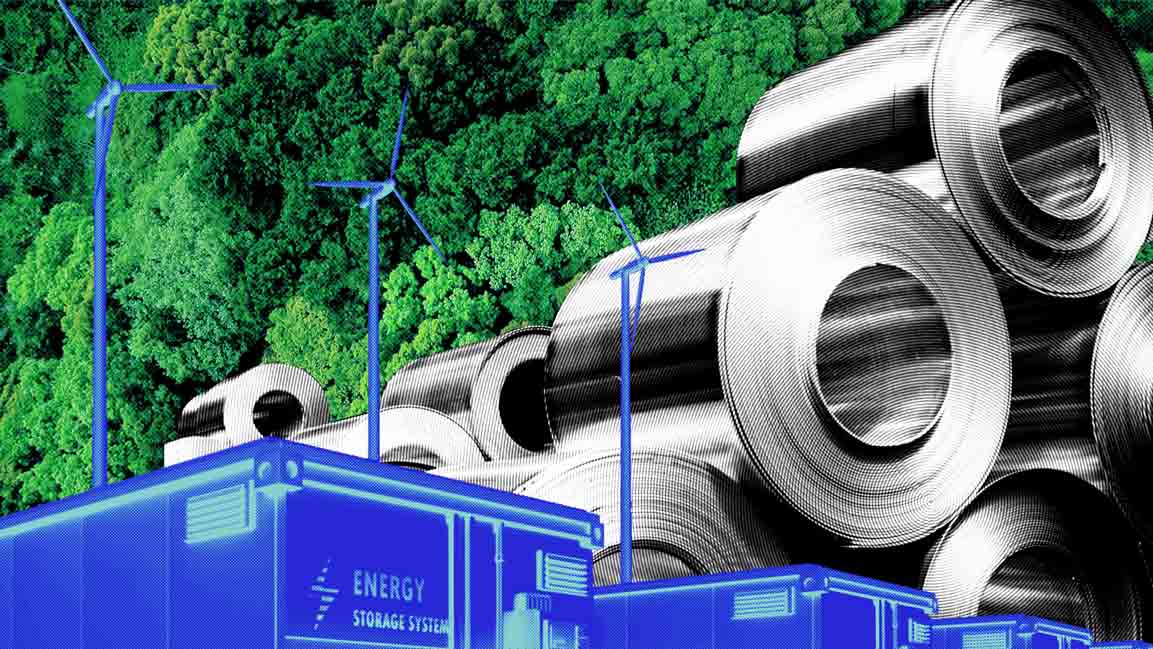

The law has about $370 billion of tax credits and incentives for renewable energy and EVs, including money and policies to encourage companies to make clean energy components in the U.S.

To be able to spend that money, federal agencies need to finalize rules and Congress needs to take additional actions to allow the spending. The latter is likely to be a challenge as Republicans now have a narrow, and chaotic, majority in the House to go along with Democrats’ control of the Senate and the executive branch.

“Congress has an important role to play in guiding the swift and effective implementation of the IRA,” said Jose Zayas, executive vice president of policy and programs for the American Council on Renewable Energy, a trade group. “The Treasury Department is still issuing guidance related to key provisions, which will have crucial implications for developers and homeowners seeking to take advantage of a suite of new clean energy tax credits. Congress must use its oversight authority to ensure prompt completion of guidance from Treasury.”

I could go on, about continuing growth in battery storage, the push to get solar and onshore wind development back on track after a year marred by supply chain challenges and policy uncertainty, and the completion (we hope) of the long-delayed expansion of the Vogtle nuclear power plant in Georgia.

I’m looking forward to another year of telling you all about it.