- | 4:00 pm

Chris Sacca believes the next trillion-dollar companies will be focused on climate change

The billionaire investor, an early backer of Silicon Valley success stories like Twitter and Uber, is focused today on green energy and carbon removal.

Fighting climate change is no longer dependent on so-called tree-hugger activism, says investor Chris Sacca, managing partner at Lowercarbon Capital, a venture firm focused on startups that reduce emissions or remove carbon from the atmosphere.

Speaking today at Fast Company‘s Most Innovative Companies Summit, Sacca said that he’s encouraged by the fact that the climate-focused companies in Lowercarbon’s portfolio are not just helping the planet; increasingly, they’re also making money.

“I love the impact our businesses are having, but they’re real businesses and they’re getting to revenue faster than anything we’ve worked with before,” says Sacca, who previously backed startups including Stripe, Uber, Twitter, and Kickstarter. “You can actually be legitimately mission-driven and have the opportunity to build systems that will save the lives of tens of millions of people and countless species and preserve habitability on this planet and make a lot of money doing it.”

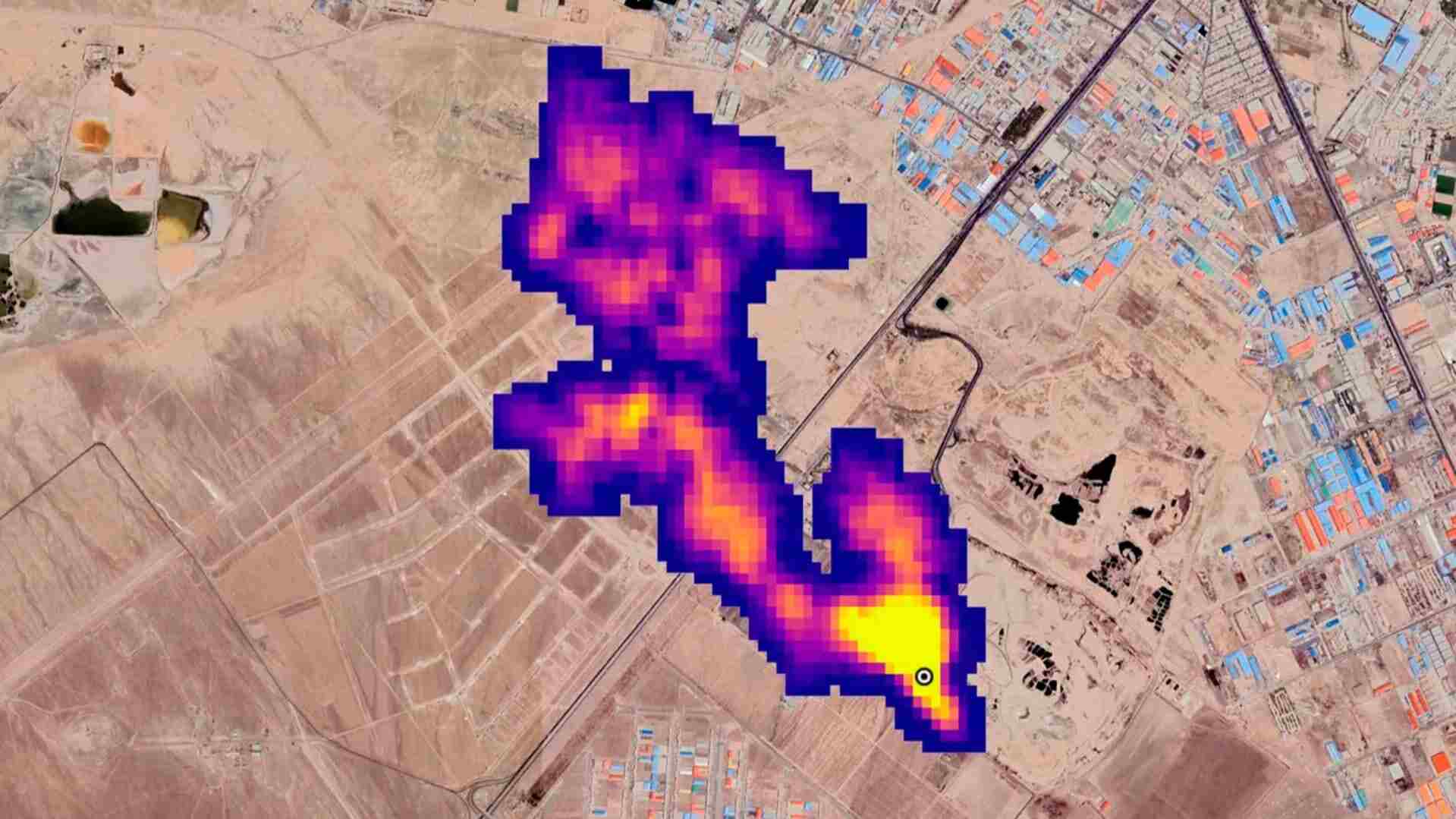

Through Lowercarbon, Sacca’s portfolio includes startups engaged in lithium mining, kelp farming, nuclear fusion, and climate risk management. Sacca founded Lowercarbon in 2018 alongside his wife, Crystal Sacca. They closed on a $800 million fund in August 2021 and followed that with a $350 million fund that closed this month. Lowercarbon primarily invests in seed and Series A-stage companies.

In Sacca’s view, the generation of climate startups taking shape today will eventually overtake the internet-era companies of the past decade. “Energy, food, transportation—all of that is touched by carbon,” he says. “And as we remove carbon from [those sectors, we see] massive opportunities. So the wealth that is being generated in climate tech right now will wildly eclipse all of the wealth generated by the internet, total. … That’s just the sheer scale of what we’re addressing.”

In the public markets, many “green” stocks are already outperforming their peers. Tesla, perhaps the most prominent example, is up 40% year-over-year and remains one of the most valuable companies in the world.

“We have a company that is four years old, it’s doing a nine-figure run rate, selling a commodity with 60% profit margins, because they do it without oil,” says Sacca. “That’s insane. I mean, think of the multiples on that and the growth. And so when I look at companies like Lilac right now, and the lithium mining space, I see that potential for trillion-dollar market caps.”

Sacca also says he’s encouraged by the collaborative atmosphere in climate tech, and hopes to see that “same team” mindset extend to the activists pushing for policy change. His second fusion investment, for example, came about following an introduction that the CEO of his first fusion investment initiated. “It was wild to see each of these competitive founders introducing us to the others,” he says. “They’re kind of rooting for each other in a weird way.”