- | 8:00 am

Brands have an Instagram engagement problem, and it’s getting worse

A new analysis of social media activity from 2,100 companies across 14 industries found Instagram engagement has been dropping, but all hope is not lost.

As you debate whether to pay Mark Zuckerberg for a blue verification badge on Instagram, here’s an interesting piece of data that you might help you decide.

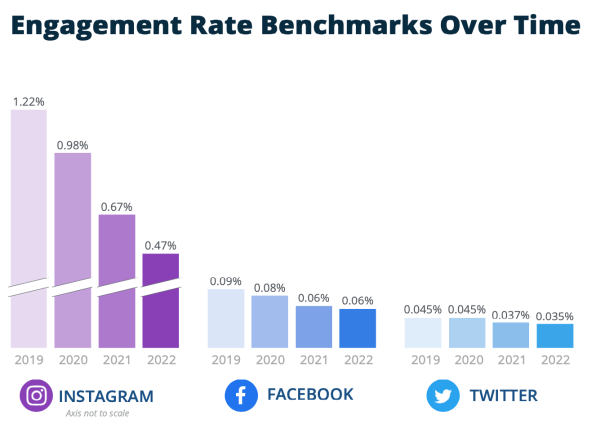

Engagement rates on Instagram have generally been falling for brands, even as those brands continue to post at the same frequency. That’s according to a new deep dive from analytics firm Rival IQ, which measured social media activity for 2,100 companies across 14 industries. It found that the median Instagram engagement rate—that is, the rate of engagements per post by follower count—was about 0.47% across industries last year, or about 30% lower than it was the year before.

In fact, the study reveals that engagement rates on the Meta-owned platform have been falling since at least 2019, when the engagement rate was at a decidedly more robust 1.22%.

The report analyzed some 841,000 Instagram posts and 2.3 billion engagements. It underscores an uncomfortable truth about social media marketing in general: The amount of time and energy that brands put into specific platforms doesn’t always correlate to returns on investment.

On a related note, it will probably come as no surprise which platform has been over-indexing in terms of brand engagement. TikTok, which appeared on Rival IQ’s report for the first time this year, produced a median per-post engagement rate of 5.69% in 2022. Again, that’s compared to a rate of less than 1% for every other platform measured in the report, which also included Facebook and Twitter.

According to Rival IQ, engagement rate is a better measure of success than, say, just looking at raw numbers of likes, shares, or followers. “To us, engagement rate per post is the metric because it controls for post volume and audience size and helps marketers understand how they’re doing in relation to their competitors,” the study’s authors say.

If you’re a brand or company that pours a lot of resources into Instagram, all hope is not lost. Rival IQ’s analysis found that some industries have fared better than others. For instance, sports teams and especially higher-education brands outperformed on the platform.

It also found that Reels—Instagram’s TikTok rival—perform especially well for many industries, including retail, health and beauty, and the food and beverage industry. “Reels have officially entered the chat on Instagram,” the report says, “dethroning ever-popular carousels for many industries in the race for the most engaging post type.”

If nothing else, these figures might reinforce the ever-increasing popularity of short-video content on social media, even though not everyone is ready or willing to embrace that shift. Personally, I’ll stick with still images and text—at least for as long as those things continue to be human-generated.

Rival IQ’s “Social Media Industry Benchmark Report” for 2023 was released on Wednesday. You can learn more about it here.