- | 8:00 am

Investors are raking in profits by privatizing water. Everyone else is paying the price

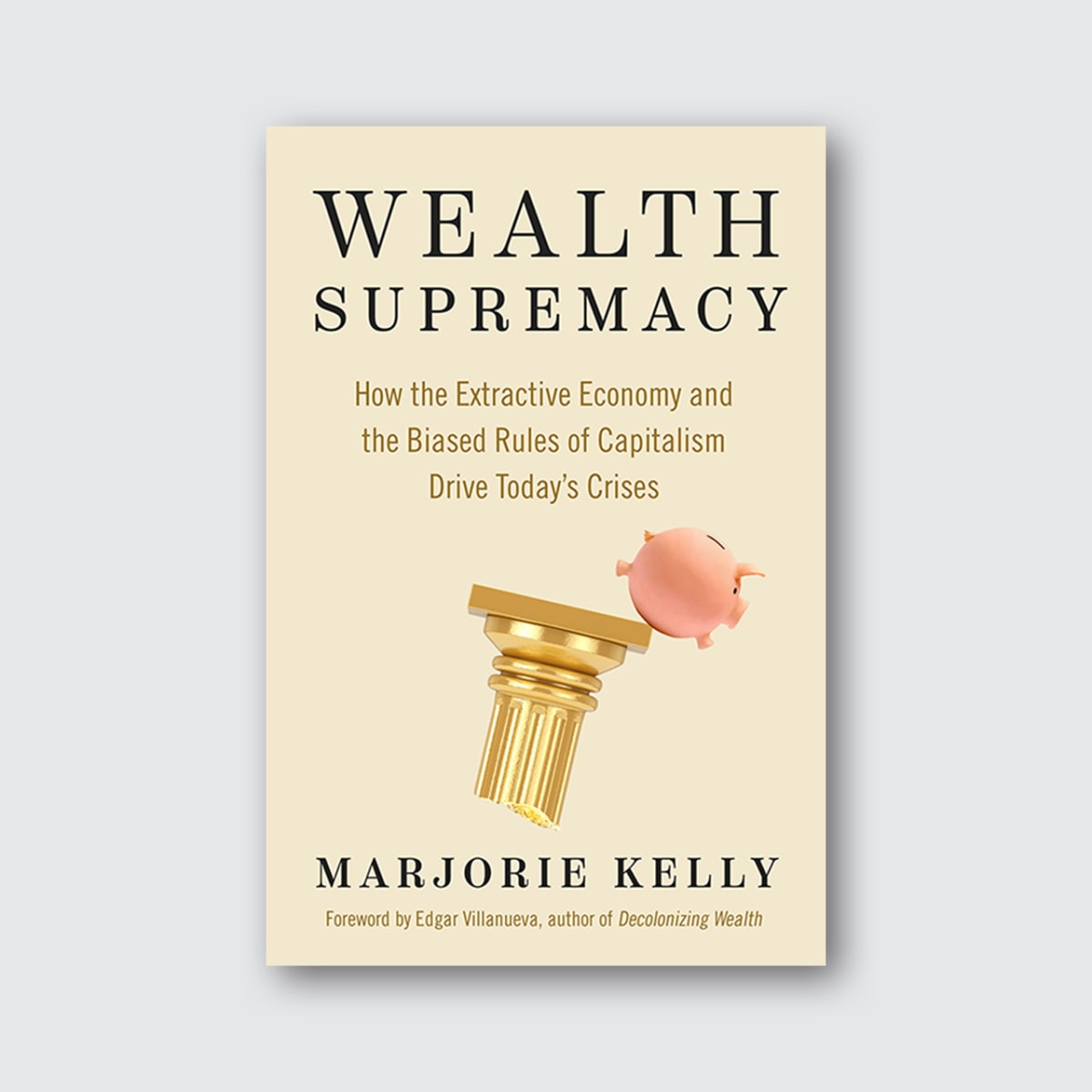

In this excerpt from her new book ‘Wealth Supremacy,’ Marjorie Kelly explores our society’s bias toward wealth, and what we all lose when too much capital is concentrated in too few hands.

In the tiny town of Cibola, Arizona, population 300, a firm called Greenstone—a subsidiary of a subsidiary of the financial conglomerate, MassMutual—quietly bought the rights to nearly all the town’s water. Greenstone set out to sell that water to the highest bidder, shifting it away from the living use of agriculture and selling it to a Phoenix suburb for purposes like filling backyard pools. As county supervisor Holly Irwin told a reporter, “They’re going to make big bucks off the water, and who’s going to suffer? It’s the rural counties going up against big money.”

Not far away, in Colorado, the hedge fund, Water Asset Management (WAM), has become one of the largest landholders in the Grand Valley west of Denver as a way of collecting water rights. The fund is doing so as the region reviews how to manage water flow from the Colorado River, which has shrunk 20% in 20 years. For the past century, management has been overseen by the Colorado River Compact, a government framework with its slow-moving, democratic process struggling toward consensus and shared sacrifice through negotiation.

Will democracy remain in control? Or will aggressive capital turn our diminishing water into a new object for financial extraction?

In May 2000, Fortune magazine observed: “Water promises to be to the 21st century what oil was to the 20th century: the precious commodity that determines the wealth of nations.”

In the eyes of big capital, water is an “undervalued asset.” Matthew Diserio, WAM’s president, is frank about his ambition—though he speaks in the cloaked language of finance. Water in the U.S. is “the biggest emerging market on Earth,” he says. It’s “a trillion-dollar market opportunity.”

In the words of Arizona assemblywoman Regina Cobb, who represents Cibola, capital wants to make water a commodity, but “that’s not what water is meant to be.” There are towns—desperate for the income and investment—that have turned management or ownership of water systems over to corporations. But voters often reject this. In Trenton and Edison, New Jersey, and Baltimore, more than 75% of voters rejected privatization. Similarly in the U.K., as Mary Grant of Food & Water Watch put it, “People feel deeply connected to water and that it needs to be in public and local control.”

Close to 85% of Americans get water from a local, democratically owned and controlled utility. This is a democratic economy already in operation. We the people right now own and control America’s water systems. We’re apparently enjoying superior service as a result. While conclusive data isn’t available, my former Democracy Collaborative colleague Thomas Hanna, now with the philanthropic organization Arnold Ventures, found that privately owned U.S. water utilities often charge higher prices, perform poorly, and leave citizens uneasy with the lack of local, direct accountability.

In these two profoundly different paradigms of water, we can read alternate paths for our future, as we slide further on the downslope of ecological disruption. Which path we take will be a matter of which economic system dominates: extractive capitalism, manifest in models like hedge funds and multinational corporations; or a democratic economy, where ownership and control is rooted in community and embodied in various models (city-controlled water, worker-owned firms, depositor-owned credit unions, state-owned banks) that recognize our inescapable interdependence—hence the need for democratic accountability, for building economic pathways toward that more perfect union of a fully democratic society.

EXTRACTIVE CAPITALISM AND WEALTH SUPREMACY

In the story of water, we can begin to see the architecture of economic system design. In one system, serving life is at the center. In the other, maximizing financial wealth is at the center.

Extractive capitalism is about more than personal greed. It embodies a worldview, a habit of mind, so pervasive as to be invisible. We can call it a bias, akin to race bias and sex bias, but toward capital and wealth, toward ensuring that economic activity is focused primarily on benefiting those who possess wealth.

When investors look at their/our portfolio returns, we step into the dreamworld of wealth, the fiction that financial gains somehow fall from the sky, pristine and unblemished. This world assumes capital interests are to be prioritized. If the needs of others are ill-served, it’s unfortunate, but investor income must be maximized.

This is wealth supremacy. It’s the bias toward wealth and capital interests that defines today’s dominant political-economic system.

Like white supremacy, wealth supremacy is both entirely obvious and oddly hidden. How long had police been killing Black people during routine interactions before George Floyd? I lived in white Minneapolis and didn’t see it, nor did millions of other white Americans.

In the same way, we see and don’t see capital bias. Fully 71% of Americans say the system is rigged. Yet, few know how it’s rigged. Its workings are veiled in the incantatory terms of finance (alpha, beta, ROI, IRR, EBITDA, ETFs). If most don’t understand the system, those who do are too busy making money to challenge its norms. As Upton Sinclair said, “It is difficult to get a man to understand something when his salary depends on his not understanding it.”

Today, as this system reaches its swollen, financialized apogee, its ongoing processes of wealth extraction are the deep force sapping societal resilience; driving, exacerbating, or profiting from today’s largest crises. Global systemic risks—climate change, biodiversity loss, deepening inequality, and rising authoritarianism—are converging into a polycrisis. While ecological overshoot is one root cause, equally implicated is what economists call financialization: the accumulation of too much financial wealth in too few hands.

The long rise of irresponsible consumption has been driven by corporations’ drive to maximize profits. Climate change solutions have been blocked by fossil fuel companies and the capture of politics by monied interests. The white working class, left adrift by the loss of good jobs, finds its anger misdirected into racial and misogynistic hatred by conservative forces determined to preserve the social order governed by wealth, by men, by whites.

Many of us don’t grasp how the obscure, mathematical norms of our extractive system lie behind these crises. It’s rarely explained to us how expanding pools of great wealth create and rely upon the precarity and indebtedness of the rest of us. Instead, our culture tends to view “wealth creation” as benign and wonderful.

THE PROBLEM WE’RE NOT TALKING ABOUT YET

This bias toward wealth makes it difficult to digest economists’ warnings that the world is awash in too much financial capital, just as the atmosphere is awash in too much carbon.

At the individual level, maximizing investment gains makes sense—just as it makes sense, individually, to drive cars as much as we want and set thermostats as high as we want. But when we do, in the aggregate, we damage the planet’s living function.

Similarly, massive damage is created by aggregate financial extraction: families trapped by unsustainable debt, the stifling of small- and medium-size businesses that create jobs, dark money’s attack on democracy. The deep, tectonic plates of society are overloaded by too much so-called wealth and the extraction it requires. But the language and myths of the system block us from grasping this. The very words we use reflect the view of wealth. More assets! How wonderful!

In reality, every asset held by one person is a claim against someone or something else. Debt is a claim on your income. A share of stock is a claim on a company’s value, and boosting that value often means cutting workers’ income to increase profits. In the case of water systems, it means raising consumer prices so handsome dividends can be passed to shareholders.

Society is like a household struggling under crushing debt. We’re squeezed on one side by credit card debt, medical debt, college debt, second mortgages—and squeezed from the other side by low-income jobs, unstable part-time and contract work, and unaffordable homes.

A once-functional system has turned treacherous. The wealthy are extracting massively from the rest of us. This is the problem we’re not talking about yet.

As we move forward into the Anthropocene—a world of record heat waves, drought, flooding, and famine—to continue operating our economy to maximize wealth for the few is the path of madness. How we challenge this system is by naming wealth supremacy, by talking about it. It’s time for that conversation.

Adapted from Wealth Supremacy: How the Extractive Economy and the Biased Rules of Capitalism Drive Today’s Crises, by Marjorie Kelly, released September 12 by Berrett-Koehler Publishers; copyright 2023 Marjorie Kelly. Used with permission of Berrett-Koehler and the author.